Thank you CreditRepair.com for sponsoring this post. CreditRepair.com’s team understands that a credit score is not just a number; it’s a lifestyle.

When my husband and I got married, we fantasized about owning a home and raising our family in it. We’re two educated, hardworking people and we didn’t see why that dream would be difficult to achieve. Once we actually started the home buying process, though, we discovered that our credit score would play a huge role in our ability to purchase a house. Knowing this, we made a concerted effort to focus on it. By making a few adjustments to our lifestyle, our credit improved and we became first-time homeowners this Summer!

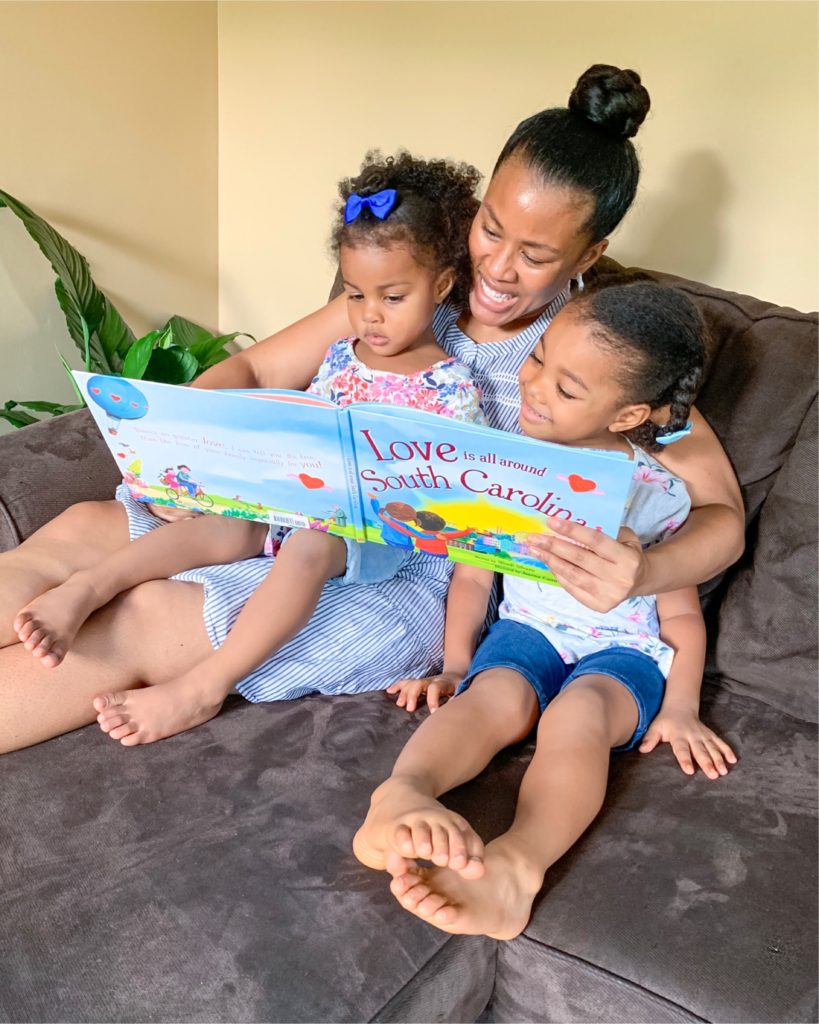

It feels so good to be done with renting and have a space that belongs to us! I love knowing that we have a permanent little corner of the world and that our girls (and cat) can grow up with a sense of stability. If you’re trying to put yourself in a position to purchase a home, your credit score can either help you or hurt you. And the fact of the matter is that good credit doesn’t occur as easily for everyone. Try these small modifications and see how your credit can improve over time:

If you’re trying to put yourself in a position to purchase a home, your credit score can either help you or hurt you. And the fact of the matter is that good credit doesn’t occur as easily for everyone. Try these small modifications and see how your credit can improve over time:

Know Your Credit Score

When you’re thinking about buying a house, it’s important to be aware of your starting point and how you got there. Your credit report factors in everything from your entire financial history to give you a credit score. If that score is not currently where you want it to be, that’s okay! The professionals at CreditRepair.com are there to help!

CreditRepair.com is one of the leading providers of credit report repair services in the country. They provide personalized analyses and guidance throughout your credit repair journey.

The thing that has stuck out most to me about CreditRepair.com is their commitment to customers as real people and not just numbers. They have three basic goals for every person they encounter:

- Achieve their dreams.

- Increase their ability.

- Enjoy a lifestyle of greater opportunity.

I love that they recognize that everyone’s credit scores and life experiences are a little different and they work to accommodate each individual. Your credit score is not permanent and there are definitely ways to fix it. You can get started today with a free consultation to gauge your needs!

They also offer multiple tools to stay connected and informed. In addition to a personal online dashboard, they have mobile apps, a credit score tracker, and text and email alerts so you’ll never miss an update.

Pay Bills on Time

Your credit score is impacted by whether or not your bills are paid punctually over the course of time. Late payments can definitely hurt your credit. One great way to make sure this does not become an issue is to schedule autopay for recurring bills. Setting alarms and notifications in your phone or calendar can also help you stay on track.

Handle Debt and Credit Cards Responsibly

Along the same lines, your credit score reflects your debt. Make sure to keep a close eye on your debt and when you use your credit cards, keep your balances low. Don’t charge purchases that you don’t intend to pay off on time. And put as much money as you can toward your debt, as often as you can, so that you can pay it off sooner.

Buying a house comes with a lot of expenses. We use a budget to monitor our spending and make sure that we’re living within our means.

Don’t Despair

Regardless of your current credit score, know that there is hope for it to improve! Join their 500,000 clients by talking to the awesome team at CreditRepair.com and seeing how their customized plan can help you get closer to becoming a homeowner. It takes time to build your credit and effort to actively improve it. But the good news is that CreditRepair.com has all of the tools you need. Follow their advice and you’ll be buying a home before you know it!

What are your credit goals?

See more about how we manage our finances on one income and how meal planning is a huge help!

Talk to you soon!